SST Expertise: Are You Accurately Reporting Grants and Contributions?

Has your nonprofit organization addressed the effects of the new Accounting Standards Update (ASU) regarding contributions received and contributions made? Is your organization required to issue GAAP financial statements? If so, you must implement this new standard.

Read on as SST’s Senior Audit Manager, Bridget Losa, outlines what you need to know to be in accordance when reporting grants and contributions this year.

In June 2018, the Financial Accounting Standards Board (FASB) issued ASU 2018-08, Not-for Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. The ASU is effective for resource recipients with annual periods beginning after Dec. 15, 2018, and resource providers with annual periods beginning after Dec. 15, 2019.

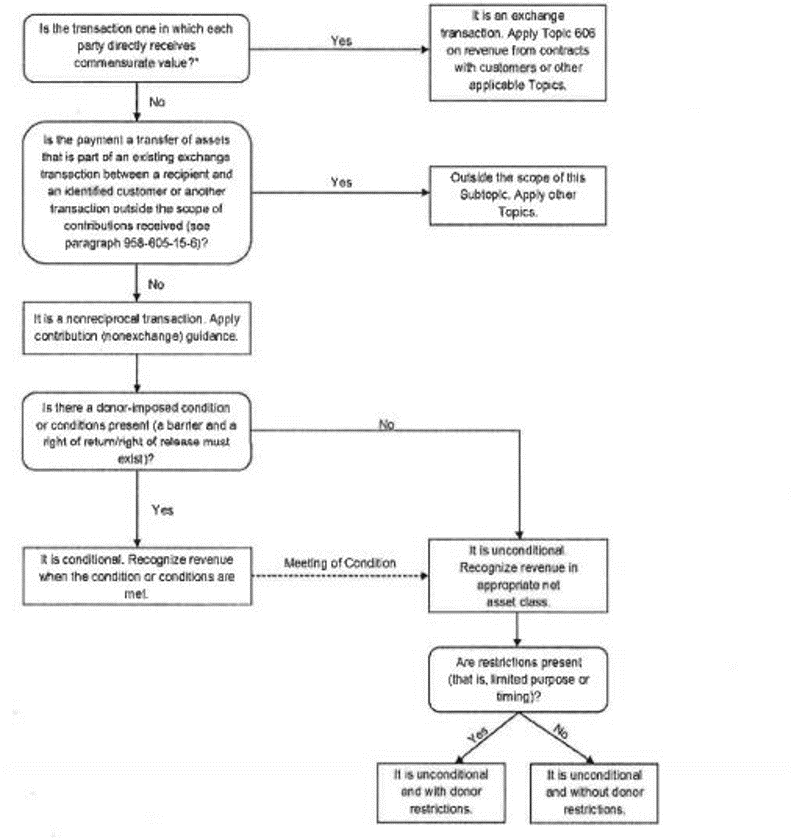

The major aspect of the ASU requires the organization to determine if a transaction is reciprocal (exchange) or nonreciprocal (nonexchange). Next, the organization must determine if the contribution is conditional or unconditional.

Determining Reciprocal or Nonreciprocal

Does the provider receive direct commensurate value for the contribution? If so, the transaction is reciprocal. This does not include any benefit the general public may receive due to the contribution. If the organization determines the transaction is nonreciprocal, the next step is to determine if it is conditional or unconditional.

Determining Conditional or Unconditional

A contribution is conditional if the agreement includes a right of return/release and a barrier. An organization will need to consider the following when determining if a barrier exists:

- Is there a measurable barrier? (ex: performance-related barrier)

- What is the extent to which a stipulation limits discretion by the recipient on the conduct of the activity?

- What is the extent to which a stipulation is related to the purpose of the agreement?

The following flowchart included in the ASU walks through this decision process:

If the organization determines the transaction is nonreciprocal and conditional the contribution is recorded as a deferred revenue until the conditions are met. It is then considered unconditional and recognized as revenue if there are not restrictions present, such as time or purpose.

The following are other important factors to consider when adopting the new ASU:

- It applies to all entities that receive or make contributions.

- It excludes transfers of assets from government to business entities.

- It applies to both contributions received by a recipient and contributions made by a resource provider. The entities do not need to track each other’s accounting.

- The financial statement revenue descriptions terminology is not affected.

If you want to ensure your organization is in accordance with these updates or if you have any questions, SST is here to help. Contact us for more.