Faith-Based Organizations: New Charitable Deduction for Non-Itemizers

Please note: This blog is current to the date of its publication, Monday, Sept. 14. For additional updates or assistance navigating these uncertain times, please contact us or visit our SST COVID-19 resource page.

Every church has a small group of adults who provide little or no financial support. This season is not only a great time to encourage them to take the first step toward stewardship, but to also make them aware of the new charitable tax deduction available to those who do not itemize their contributions. Below, SST’s experts have outlined the steps church leaders should take to encourage and incentivize donations.

Just Get Started

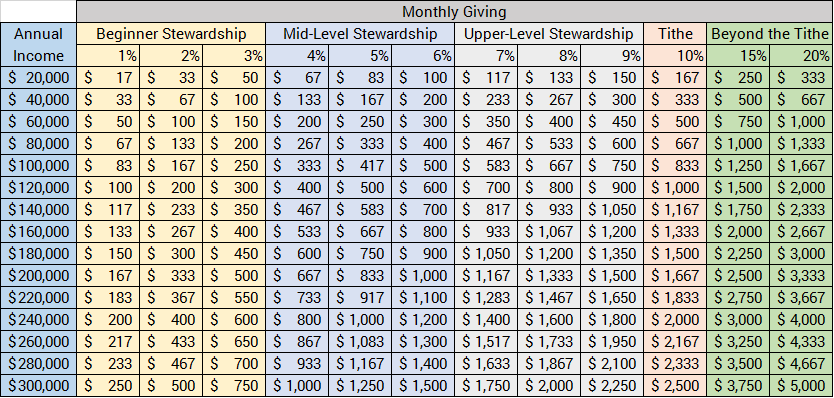

The way we begin anything new is to take the first step, as daunting as it may be, and just get started. Provide your members with a chart such as the one below, which illustrates what it takes to get started on the path to dedicated, personal stewardship.

Understand the New Charitable Deduction

Church leaders know that a person should not need an enticement to give, but it certainly may guide a person to take that first step. One provision in the Coronavirus Aid, Relief, and Economic Security (CARES) Act permits eligible individuals to deduct $300 of qualified charitable contributions as an “above-the-line” deduction. Eligible individuals are those who do not itemize deductions on their income tax returns. This provision is for tax years beginning in 2020.

This new “above-the-line” deduction is limited to cash contributions only. Non-cash contributions, such as clothing or other items, are not allowed. However, non-cash contributions are still allowed for those who do itemize their returns.

Alert the People

As we approach the end of the year, this is a great time to inform your church community of this opportunity. While these changes may seem small, they could start a person on the road to a higher level of stewardship in the future.

For more information, please refer to IRS Publication 526, Charitable Contributions, or contact the experts at SST for assistance.

Special thanks to SST Manager of Client Accounting and Advisory Services Simeon May, CPA, CCA, CAE, for providing the content for this post. Click here to learn more about Simeon.